Real Estate Sector in Italy: Opportunities and Challenges for the Future

Real Estate Sector in Italy: Opportunities and Challenges for the Future

In recent years, the Italian real estate sector has undergone significant transformation, driven by rising demand for rentals and renewed investments. Despite this growth, the market faces challenges such as infrastructure barriers and the need for renewal. The capital is at the center of growing interest from national and international investors, particularly in luxury hotels and residential properties.

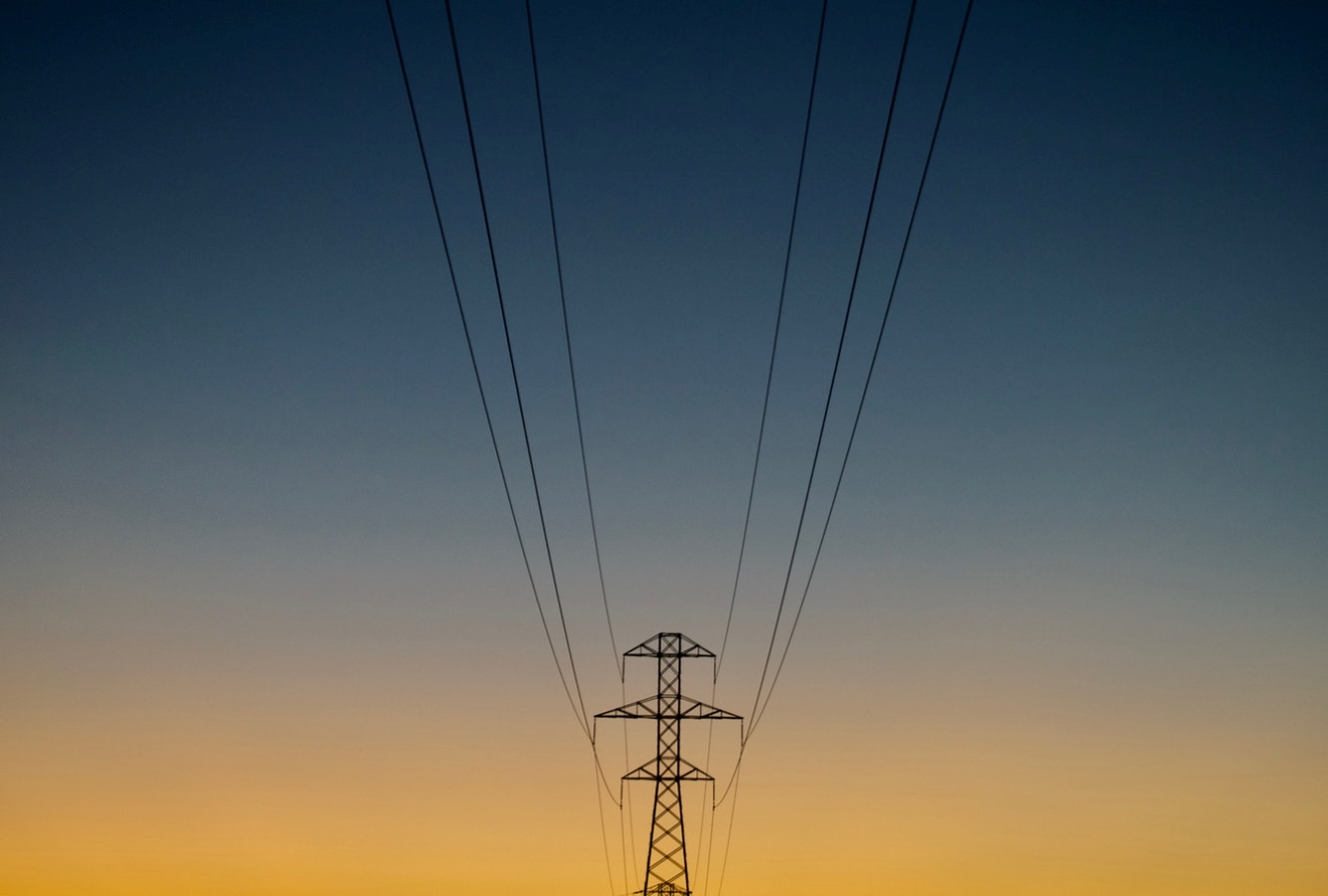

Rome and the Increase in Investments in Hotels and Infrastructure

As a focal point for urban regeneration projects, Rome is attracting capital, while the rental market is accelerating nationwide, particularly in southern Italy. During the “Investing in Rome 2024” event by Il Sole 24 Ore, Giuseppe Amitrano, CEO of Dils, noted that the city is recovering quickly from the post-Covid period. Estimates for 2025 suggest investments between 3 and 4 billion euros, marking a significant turning point. However, infrastructure and public service gaps complicate the process, highlighting the need for better collaboration between the private sector and public administration to create long-term solutions. Social and affordable housing projects have emerged as key responses to rising housing demand.

The Rental Market: Boom in Southern Italy

The rental market is shifting, with rental times reduced by 40% nationwide. In southern cities like Palermo and Naples, rental times have decreased by 52% and 48%, respectively. Factors such as rising mortgage costs have made renting more attractive than purchasing. Additionally, demand for temporary housing from young people and students has reduced waiting times in cities like Genoa and Turin, where the average wait is now 2-3 months. However, Venice stands as an exception, with rental times increasing due to high tourist demand.

Sustainability and ESG: A Key Factor for Funds and Investments

Sustainability and ESG (Environmental, Social, and Governance) criteria are becoming increasingly important in Italy’s real estate sector. Investment funds like DeA Capital Real Estate have received positive ratings from GRESB (Global Real Estate Sustainability Benchmark). This reflects a growing focus on sustainable investment. These standards attract capital and position real estate as a driver of responsible development. The sector is balancing economic growth with social and environmental goals.

New Housing Models: Cohousing and Social Housing

Innovative housing models like cohousing and intergenerational co-living are gaining popularity in Italy. These solutions address the needs of an aging population while providing sustainable living options. The Italian Notariat has introduced guidelines to regulate these models, emphasizing their economic and social benefits, including resource sharing and urban regeneration. Such models also promote socialization and improve the safety of the elderly, contributing to more inclusive and sustainable urban planning.

Residential Market: Price Trends and 2024 Outlook

The residential market in Italy has shown signs of recovery, with property transactions reaching 341,094 units in the first half of 2024, slightly down from 2023. However, prices in major cities like Florence and Milan are rising. The outlook for 2024 suggests moderate price growth and market stabilization, supported by potential interest rate cuts, which could encourage more property purchases.

Conclusions

The Italian real estate market is at a crucial juncture, offering significant opportunities for investors and both the public and private sectors. The main challenge is overcoming infrastructure and regulatory barriers. Policies that attract capital and improve quality of life are essential. With trends in sustainability and innovative housing models, the sector has strong growth potential. This potential depends on aligning with evolving social and environmental responsibilities.

How Proaxxes Can Support the Real Estate Sector

Proaxxes plays a pivotal role in assisting foreign companies navigating the complexities of Italian regulations. With its deep sector expertise and extensive network, Proaxxes can help investors develop real estate strategies that incorporate sustainability, innovation, and economic growth, fostering a greener, more competitive sector while addressing current challenges and setting the stage for future growth. Contact us!